Financial IntelligenceMeets Tax Mastery

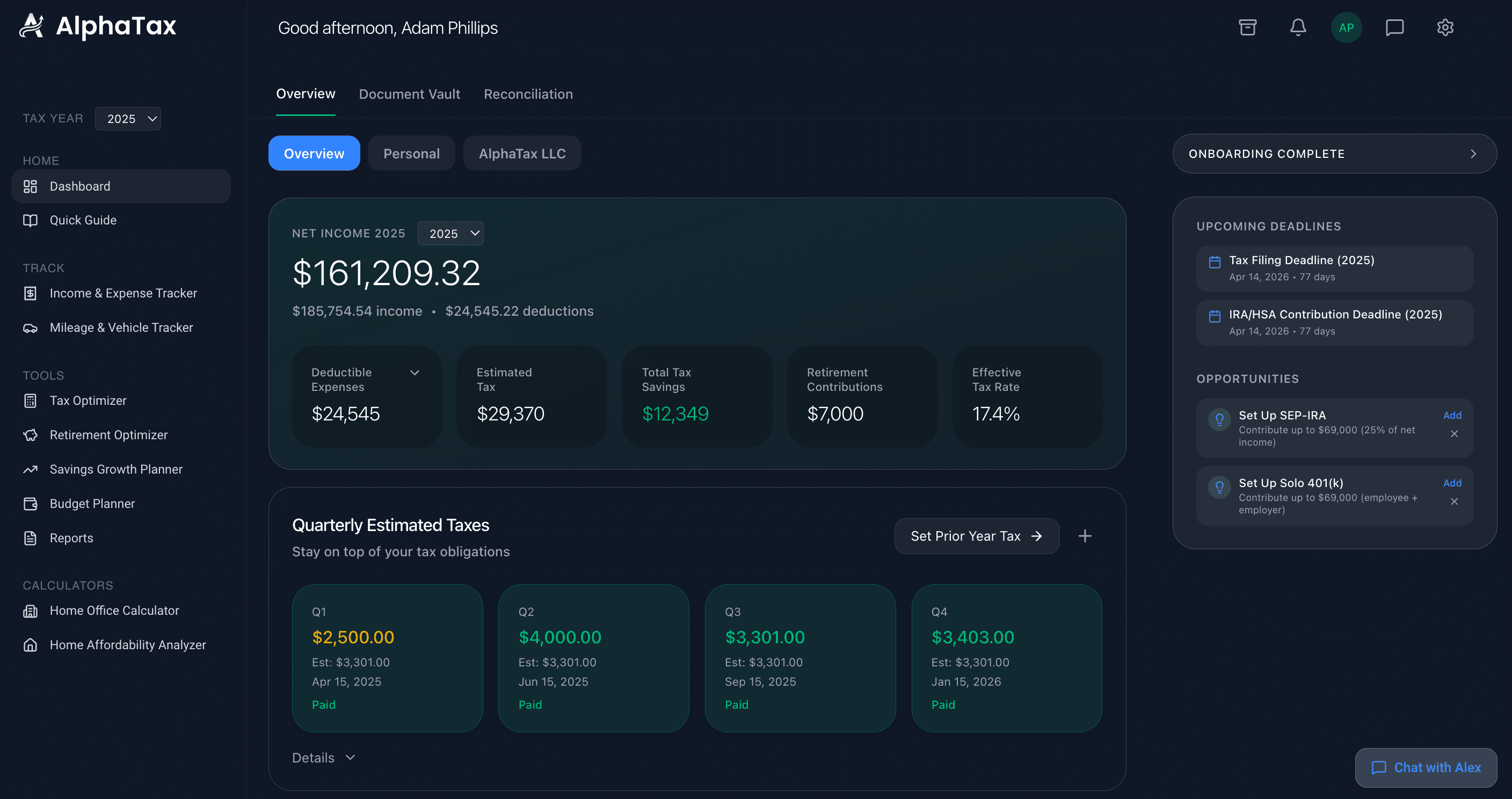

Real-time expense tracking, AI-powered deduction discovery, and intelligent tax optimization—all in one premium platform built for modern professionals.

Complete tax planning

and optimization platform

AI-powered deduction discovery and categorization meets personalized strategic tax planning—all working together to minimize your liability year-round

AI Deduction Discovery

Connect once, track automatically

Connect your bank accounts via Plaid or upload statements—our AI categorizes every transaction and identifies deductible expenses. Smart deduplication ensures accuracy across all accounts, building the foundation for strategic tax planning.

Income & Expense Tracker

Track and categorize business expenses

Strategic Tax Planning

See exactly how to reduce your liability

Using your discovered deductions and financial profile, our AI suggests personalized strategies—from accurately categorizing business expenses to advanced retirement account contributions. Our AI employs over 25 current strategies and custom tailors its suggestions to your income, expense, personal and entity profile-illustrating multiple options for a full tax minimization strategy. Adjust parameters and watch your tax liability update in real-time.

Tax Optimization Strategies

Reduce your tax bill by $15,247

AI-Powered Support Assistant, Alex

Contextual intelligence with extreme relevance

Experience support that truly understands your situation. Our AI assistant, Alex, has deep knowledge of your account data, financial preferences, and complete tax profile—enabling answers tailored specifically to you. Get instant guidance on features and tool usage, receive data-driven calculations for questions like quarterly tax estimates, and access real-time IRS tax code references for complex tax questions. Available 24/7 with contextual intelligence that makes every interaction relevant and actionable.

AI Support Assistant

Contextual intelligence • 24/7

How much will I owe in quarterly tax next quarter?

Based on your current income and deductions:

GPS Mileage Tracking

Automatic business mile logging

Track business mileage automatically with GPS (native app feature). Compare standard mileage rate vs. actual vehicle expenses to maximize deductions. All tracked miles flow into your Income & Expense Tracker and ultimately into the Income Tax Optimizer.

Mileage & Vehicle Tracker

GPS trip tracking • 2025

Retirement Contribution Strategy

Maximize tax-deferred growth with smart account selection

Get monthly suggestions for retirement contribution planning across all account types. Compare Traditional vs. Roth accounts to see which provides better tax benefits based on your current and projected tax rates. Analyze whether Roth conversions make sense for your situation by calculating the long-term tax impact. Integrated with your tax data to show real-time impacts on current-year liability while building long-term wealth. Perfect for high earners planning SEP-IRA, 401(k), backdoor Roth strategies, and strategic conversions.

Retirement Contribution Tracker

Maximize tax-deferred growth

Year-Round Optimization, Optional Filing

Track expenses and optimize taxes all year.

At tax time, choose simple filing or export everything to your CPA—whatever works best for you.

All data flows automatically

Track once in our tools, never re-enter data

Simple filing coming soon (for additional fee)

Form 1040, Schedule C, standard deductions, single state

Professional CPA export for complex returns

K-1s, investments, rental properties, multi-state—we help you plan and strategize, your CPA checks and files

Tax Filing

Form 1040 • Pre-filled & optimized

Everything works together

From the moment you connect your accounts to the day you file, every feature feeds into the next—creating a seamless tax optimization and filing experience designed to maximize your savings.

Tax optimization

made simple

From connection to filing in three straightforward steps

Connect & Discover

Link accounts in 60 seconds

Connect your bank accounts via Plaid or upload statements. Our AI categorizes transactions and discovers deductible expenses automatically.

- Bank-level security

- Smart categorization

- Duplicate detection

- Real-time sync

Optimize & Plan

See your tax-saving strategies

Review AI-recommended strategies tailored to your financial situation. Adjust contributions, apply deductions, and watch your tax liability decrease in real-time.

- Personalized strategies

- Live tax calculations

- Scenario modeling

- Year-round planning

Export or Simple File

Share with your CPA or file yourself

Export comprehensive tax summaries. All your deductions, strategies, and optimizations are organized and ready—whether you file yourself or work with a tax professional.

- Professional CPA-ready export

- Comprehensive tax summaries

- Year-round optimization

Simple filing coming soon for basic returns only (Form 1040, Schedule C, standard deductions, single state). Complex returns receive professional export packages.

One Price. Everything Included.

Start your 7-day free trial and unlock the complete AlphaTax platform

Your subscription is 100% tax deductible

Everything you need to maximize your tax savings

Tracking & Automation

- Bank & credit card sync (soon)

- GPS mileage tracking (soon)

- Receipt storage & AI categorization (live)

- Statement upload & AI categorization (live)

- Manual expense & mileage tracking (live)

Tax Planning & Optimization (All Live)

- AI-powered tax strategy optimizer

- Full year tax tracking dashboard

- AI deduction finder & discovery

- Tax scenario modeling

- Multiple business tracking

- Standard deduction comparison

- Monthly & Quarterly strategy reports

- Automated tax deadline alerts & reminders

Calculators & Tools (All Live)

- Home affordability calculator

- Retirement contribution optimizer

- Quarterly tax estimator and tracker

- Home office calculator

- All standalone calculators

Export & Filing

- Professional CPA-ready export (PDF)

- Optional tax filing add-on (coming soon)

Support & Assistance

- AI-powered support assistant

- Same-day email support

Year-Round Optimization,

Optional Filing

Track expenses and optimize taxes all year. At tax time, choose simple filing or export everything to your CPA—whatever works best for you.

All data flows automatically

Track once in our tools, never re-enter data

Simple filing available ($59.99 federal + $39.99 state)

Form 1040, Schedule C, standard deductions, single state

Professional CPA export for complex returns

K-1s, investments, rental properties, multi-state—we help you plan and strategize, your CPA checks and files

Your Tax Summary

Ready to fileFrom year-round tracking • Pre-filled & optimized

Frequently asked questions

Everything you need to know about AlphaTax